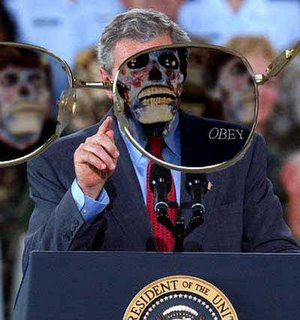

Sometimes I just can’t add any words to the facts. The American Middle Class is in deep trouble, deliberately put there by George W. Bush and his minions. There is a clear and vicious reason to destroy the Middle Class, and it has everything to do with seizing absolute control of this country.

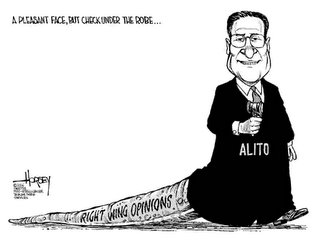

With the promotion of Samuel Alito to the Supreme Court, the Fascist win control of that body. This means that the Executive, Bush or some clone, will gain absolute ascendancy over the Tripartite Government, and we will have ourselves a King. Additionally, since Fascism is, by definition, when Corporate power controls the decisions of the Government, we will have firmly placed the stranglers hands around our collective throat.

Every time I think that things could not get worse for Americans, and those awful fanatics in power couldn’t damage Democracy any further…they of course do.

What's wrong with the economy?

by EPI President Lawrence Mishel and Policy Director Ross Eisenbrey

1. Profits are up, but the wages and the incomes of average Americans are down.

- Inflation-adjusted hourly and weekly wages are still below where they were at the start of the recovery in November 2001. Yet, productivity—the growth of the economic pie—is up by 13.5%.

- Wage growth has been shortchanged because 35% of the growth of total income in the corporate sector has been distributed as corporate profits, far more than the 22% in previous periods.

- Consequently, median household income (inflation-adjusted) has fallen five years in a row and was 4% lower in 2004 than in 1999, falling from $46,129 to $44,389.

- The indebtedness of U.S. households, after adjusting for inflation, has risen 35.7% over the last four years.

- The level of debt as a percent of after-tax income is the highest ever measured in our history. Mortgage and consumer debt is now 115% of after-tax income, twice the level of 30 years ago.

- The debt-service ratio (the percent of after-tax income that goes to pay off debts) is at an all-time high of 13.6%.

- The personal savings rate is negative for the first time since WWII.

- The United States has only 1.3% more jobs today (excluding the effects of Hurricane Katrina) than in March 2001 (the start of the recession). Private sector jobs are up only 0.8%. At this stage of previous business cycles, jobs had grown by an average of 8.8% and never less than 6.0%.

- The unemployment rate is relatively low at 5%, but still higher than the 4% in 2000. Plus, the percent of the population that has a job has never recovered since the recession and is still 1.3% lower than in March 2001. If the employment rate had returned to pre-recession levels, 3 million more people would be employed.

- More than 3 million manufacturing jobs have been lost since January 2000.

- The poverty rate rose from 11.3% in 2000 to 12.7% in 2004.

- The number of people living in poverty has increased by 5.4 million since 2000.

- More children are living in poverty: the child poverty rate increased from 16.2% in 2000 to 17.8% in 2004.

- Households are spending more on health care. Family health costs rose 43-45% for married couples with children, single mothers, and young singles from 2000 to 2003.

- Employers are cutting back on health insurance. Last year, the percent of people with employer-provided health insurance fell for the fourth year in a row. Nearly 3.7 million fewer people had employer-provided insurance in 2004 than in 2000. Taking population growth into account, 11 million more people would have had employer-provided health insurance in 2004 if the coverage rate had remained at the 2000 level.

=====================

The Rapid Disappearance of America's Middle Class

by Floyd J. McKay

“In Harvard Magazine Warren documents what many of us have felt anecdotally: "During the past generation, the American middle-class family that once could count on hard work and fair play to keep itself financially secure has been transformed by economic risk and new realities. Now a pink slip, a bad diagnosis, or a disappearing spouse can reduce a family from solidly middle class to newly poor in a few months."

The danger, Warren finds, comes from both ends of the financial spectrum: a decline in real wages for full-time workers and huge increases in basic family expenses. As a result, families are staying afloat only because both partners work.

Male full-time workers in 2003 earned $800 less than their counterparts in 1970, after adjustment for inflation. Enter the second paycheck, and the family's combined income goes to $73,700 a year, a huge 75 percent increase from 1970…”

“…Globalization has reduced the cost of most household spending — clothing, food, appliances. Americans spend less on discretionary items than in 1970. It's the basic costs that are killing us, particularly housing and medical….”

(Published on Wednesday, January 11, 2006 by the Seattle Times )

No comments:

Post a Comment