Today I tuned in to the CBS Morning show, with Katie and Matt. It was interesting, sort of like poking your eye with a stick to see if it was still painful. From a propaganda and sociological standpoint it was a lesson in applied propaganda. This show was mostly about the astonishing strength and dominence of the U.S. economy. According to this program, the U.S. economy is strong and gaining strength every moment. Why things are just cherry in the land of red, white and blue. No troubles here boy, nosiree. Why we is as rich and flagrantly consumed with consumerism as is possible to be.

Katie Couric is a well groomed, smily cheerleader, with the coldest eyes I have ever seen. She cannot even pretend to hide her soulless existence as front woman for the Bush Propaganda Machine. Then there is good old Matt, a man who would crawl on broken glass to kiss a republican ass. Well, the government trotted them out to sing the song today boy.

On this program, they had a reporter from MSNBC who loudly and with grand arm gestures trumpeted the amazing Economic power of the U.S. of A. According to these people, the stock market is going strong, good jobs are growing plentiful, the housing market is still wonderful, and the land of milk and honey does dripth over the rim of our alms cup...er, chalice. The only dull spot on this glowing tribute was the sad realization that we shouldn't buy that 4th home. Ok to have the main digs, and maybe a couple of vacation houses, but that fourth one is a bit too much right now.

A ‘fourth’ home? Who are these people? Do you know anyone who is seriously comtemplating buying more than even one vacation home? I mean someone who is still on their medication. What is that about?

But their message was clear; “Buy, Buy, Buy; spend like there is no tomorrow and you will be considered a 'good 'Merican'.”

Personally, I think there is a lot of bullshit going on here.

Americans have been spending more than they earn for the past several years. They have mortgaged their homes to the hilt, drawing out all their equity to buy new toys, take dream vacations, pay bills. They now have massive credit card debt, and they have almost no savings. Yet still they buy and are leveraged to the hilt. Talk about living on a thin edge. Yet, the Government of George W. Bush would have us all believe that things are going just ducky. They trot out Katie and Matt to lead the flag waving. The propaganda here is that we are all fine and wealthy and we should just keep spending more than we earn as fast as we can.

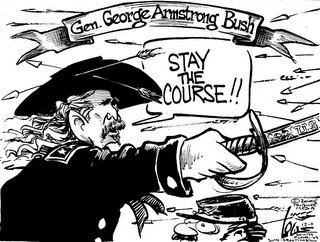

But the truth is really more sobering. In fact, the very hysteria that surrounds this propaganda is proof of the desperation of the situation. Bush has to have his minions scream real loud to hide the sounds of misery that grip the American People. But, it is similar to everything Bush has already done, say one thing loud enough and long enough and people will believe it.

To be truthful though, we must also look to the predatory corporations who really rule this land. They too know the power of lying large to convince people to follow their commands, afterall, the very science of advertising relies on this.

Again, I tend to think that the real economy, that is, the plight of ordinary citizens in this country, are doing far worse than is reported. Corporations and Politicians are desperate to keep this information quiet. If people really knew that things are not going well, and that big trouble is ahead of us, they would certainly change their economic behavior. As Reich points out in the following article, “Consumer Spending is more than three-quarters of the whole national economy”. That is huge. This spending is dependent on consumer attitudes and beliefs. Therefore the consumers must be fooled into believing that all things are good and that our leaders are wise and compassionate.

The public must be convinced to maintain their profligate ways or the entire house of cards will collapse. That is real truth here.

Published on Thursday, December 1, 2005 by CommonDreams.org

'Tis The Season To Be Broke

by Robert B. Reich

'Tis the season for retailers to be jolly if American consumers empty their wallets over the next three weeks. But how can we empty our wallets if our wallets are already empty?

Consumer confidence appears to have bounced back from the low brought on by the hurricanes and subsequently high gas prices. But it’s still below what it was before Katrina. And last week’s survey by the Conference Board showed something of a drop in shopper enthusiasm. Households say they intend to spend a bit less this holiday season than last.

Consumer spending is now more than three-quarters of the whole national economy – a record high. There’s nothing left to spend. Yes, gas prices have settled down a bit, but so have paychecks. General Motors, Merck, and major airlines are laying off tens of thousands. Job growth is anemic and pay is lousy. American families have exhausted all the coping mechanisms we’ve been using for years to spend more.

The first coping mechanism, which began decades ago when mens’ hourly wages first began dropping, was for spouses to go into paid work. But now that most adult women are on payrolls – including even the mothers of toddlers – this strategy has generated just about all the cash it can.

How else to pay for more spending? The second coping mechanism has been to work longer hours. This past year, the typical working American put in two full weeks more at the office or factory than was the case two decades ago. Americans are now working harder than even the notoriously industrious Japanese. But we’ve reached the limit. I mean, we have to sleep.

Which brings us to the third coping mechanism – taking equity out of our homes. Last year alone, Americans pulled out $600 billion through refinancing. But this cash machine is also about depleted because housing values have leveled off and mortgage rates are rising.

Where else to find the money? The final coping mechanism is to go deeper into debt. For five years now, American households have spent more money than they’ve earned – pushing their debt to a record high. But we’ve hit the wall here, too, folks. Interest payments on all that debt are exploding.

On top of that, there are tens of millions of baby boomers within sight of retirement. They have to start saving, or else their twilight years will be spent in darkness.

Put it all together and you see why we’re running on empty. We’re busted. We’ve exhausted all the coping mechanisms for spending more. Our buying binge has to come to an end.

The only question is whether the binge stops before Christmas shopping season, or American consumers make one big, final, irresponsible splurge over the next three weeks, and then call it quits.

Robert B. Reich was U.S. Secretary of Labor in the Clinton administration, and co-founder of the American Prospect magazine. He also offers weekly comments for NPR's "Marketplace." The above is his most recent commentary.

###

No comments:

Post a Comment